Budget 2024-2025: Pakistan imposed high taxes on high-salaried individuals

Pakistan has announced its Budget 2024-2025 by imposing high taxes on high-salaried individuals. Hence, high-income people should prepare for increased income taxes as the government implements efforts to boost revenue and reduce the current deficit of Pakistan.

The government made this step to increase the number of people under the tax collection umbrella towards contributing to national financial goodness. This is because those in the salaried class have documented income, which makes it easier to bring them under the tax base.

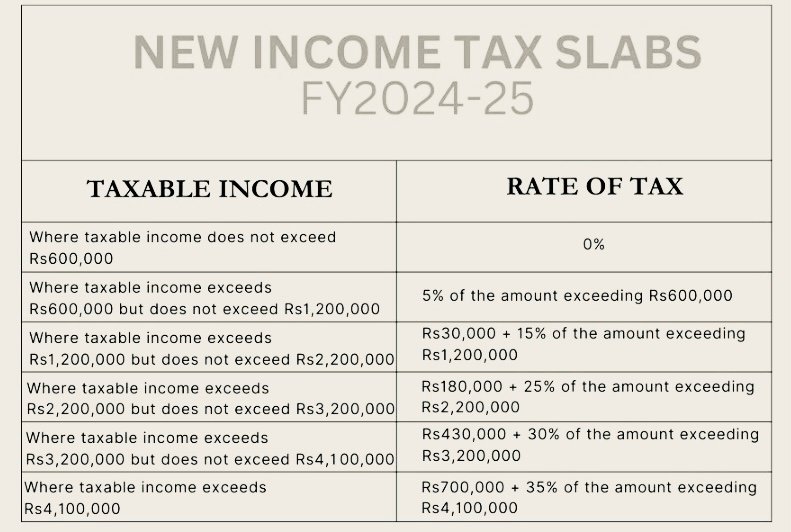

People earning up to 6 lakh rupees annually don’t have to comply with this new income tax policy. The government of Pakistan has imposed income tax on high-salaried individuals with the following rate of tax under Budget 2024-2025:

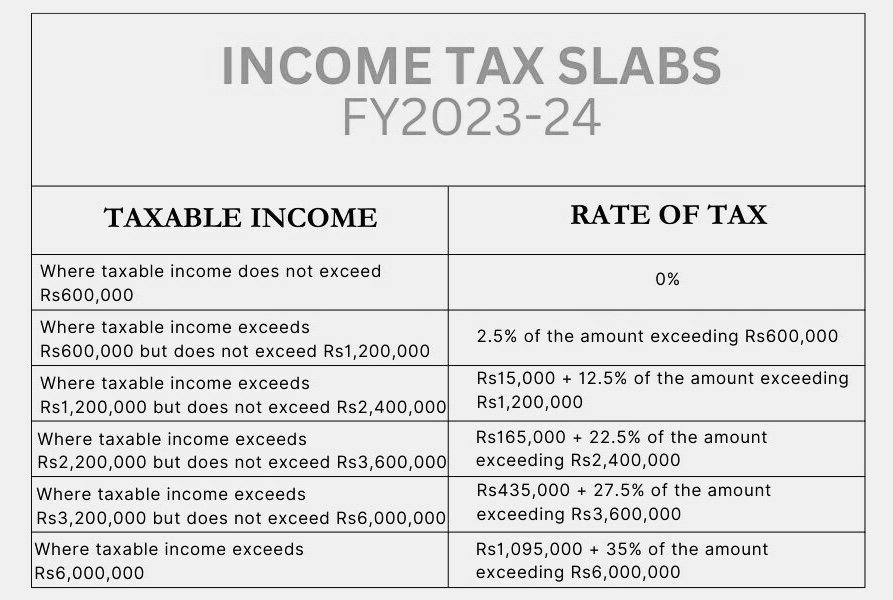

The previous tax rates under the finance bill 2023 were as follows:

The government didn’t change the income tax exemption limit, which remains at PKR 50,000 per month. However, taxes have gone up for all other income levels. For instance, someone earning Rs 100,000 a month will now pay Rs 2,500 in taxes each month, instead of the previous amount of Rs 1,250.

Click here to read the comparative report of the economic performance of PTI vs PMLN 2013-2022

Main highlights of Budget 2024-2025

- Non-tax filers will pay up to 45% tax in Capital Gains (CGT) while tax filers will pay much lower tax as 15%.

- The Federal Board of Revenue (FBR) aims to collect PKR 12.97 trillion in taxes. It is 38% more than collected last year.

- The government plans to invest PKR 1.5 trillion in public sector development projects (PSDP). It is 101% more than the amount spent the last year.

- 25% salary increase for 1-16 grade government employees and 20% for 17-22 grade employees

- PKR 4 billion to support the use of the electric bikes scheme and PKR 2 billion for energy-saving fans

- Cooking oil and ghee prices have dropped by PKR 75

The government of Pakistan has set a target for a GDP deficit of 3.6% for fiscal year 2024-2025. It presented a budget cost of PKR 18.9 trillion.

The military and defense expenditure will take PKR 2.1 trillion while pension payments allocated at PKR 1 trillion in this budget. The total non-tax revenue target is PKR 3.5 trillion.

In brief, the Pakistani government has presented a moderate budget with major adjustments for Budget 2024-2025. Pakistan has long been struggling with a poor economic state. Hence, it will be very challenging for the government to reduce the GDP deficit by 3% from 6.9%.

Read More:

- Former journalist Syed Abdullah Hassan died in Karachi at 40

- Pakistanis can now travel from Pakistan to China through a bus

- Pakistani man arrested in New York in alleged plan to kill Jewish people

- Pervaiz Musharraf’s family property auctioned for INR 1.38 Crore in UP

- FBR announced tax card for salaried employees. Here all you need to know

- LHC ordered removal of Lt. General Munir Afsar as NADRA Chairman

Share this content:

Post Comment